Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

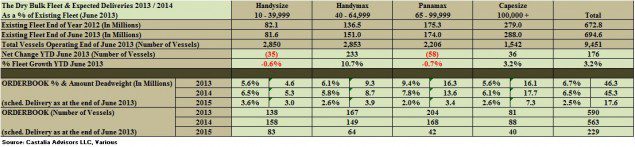

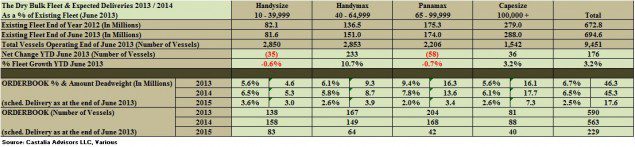

At the end of 2012 the dry bulk fleet comprised approximately 672.8 million deadweight (“dwt”) or 9,275 ships, including Handysize, Handymax, Panamax and Capesize vessels. By June 30, 2013, the dry bulk fleet had grown to 694.4 million dwt., a net increase of 3.2%, or 9,451 ships. The dry bulk fleet grew by approximately 22 million dwt and by 176 vessels.

During this period the dry bulk fleet orderbook through 2016 declined only 11 million dwt, an effective total dry bulk fleet growth of approximately 11 million should all deliveries come to fruition (inclusive of scrappings during the last six months).

The increase was predominantly the result of the net addition of approximately 15 million dwt Handymax capacity and 9 million dwt of Capesize capacity. The fleet lost approximately 500,000 dwt of Handysize capacity and 1.2 million dwt of Panamax capacity.

In spite of a decline in fleet capacity of Handysize and Panamax vessels, during the past six months ship owners ordered standard ships and Eco-ships at a faster pace than previously anticipated.

With the pace of ordering and future deliveries, it is inconceivable to think that shipowners are still expecting the dry bulk market to be balanced by 2015, the new consensus date for many analysts. Given the lowering of GDP growth for key countries that import and export commodities, such as China, South Korea, Japan, Australia, Brazil and India, the renewed interest by shipowners and private equity investors towards ordering newbuildings and retrofiting the current fleet for eco-design is subject for concern and is misguided.

If the Capesize and Panamax markets cannot generate appropriate positive returns during a period in time when, for instance, the Chinese government has been actively stimulating industrial production, then it seems unlikely that as the Chinese economy experiences further declines in GDP and steel production growth over the next two years, combined with continued newbuilding deliveries, that mean reversion investors and shipowners in the dry bulk sector should expect a recovery in 2014, or even 2015.

Additionally, even though we envision agricultural trade to increase by 2015/2016, the increased demand for Panamax vessels, which are the primary vessels that carry grains, may not allow Panamaxes to generate an acceptable return because of lower anticipated demand for industrial commodities and excess capacity in other dry bulk sectors.

By 2015/2016, we also expect that central bankers globally to be unwinding or a tapering of Quantitative Easing (“QE”) or a moderating accomodative monetary policies.

A slower monetary growth regime may be expected to cause asset deflation pressures on shipping assets prices at the same time the fleet is fully impacted by the delivery of the current order book.

Finally, with the unwinding or tapering of QE, shipowners should expect to be negatively impacted by rising interest rates and wider margins. Adjustments to the financial markets may cause both shipowners and their financiers additional financial stress.

Shipping is currently being filled with accidental tourists. Investors, particularly private equity investors, are focused on a short-term recovery. We believe that private equity investors may become discouraged of shipping, as returns may have not met intermediate-term targets, and unwind investments at precisely the wrong point in time.

We believe the recovery that anaylsts and mean-revision investors had been hoping for is being pushed further into the future and will have to be pushed even further out, as newbuilding deliveries, as macroeconomic conditions moderate, as financial institutions recognize and address excessive industry leverage and non-performing portfolios as well as the lack of industrial commodity expansion. And given the amount of excess shadow capacity the dry bulk market is havign to digest via its slowing steaming ships, any additional capacity ordered by investors further complicates any hope for short-term or intermediate-term recovery.

All of this we expect to contribute to at best an aenemic dry bulk shipping recovery. The dry bulk market is going to remain more challenging than most analysts and investors have the patience to deal in the years to come.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,935 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,935 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up